Bad Debts Written Off Journal Entry

2020-10-12 The Accounts Receivable Department will submit to Accounting entries to account for bad debts and write offs of accounts deemed uncollectible by the University of Georgia. However on June 12 2021 Mr.

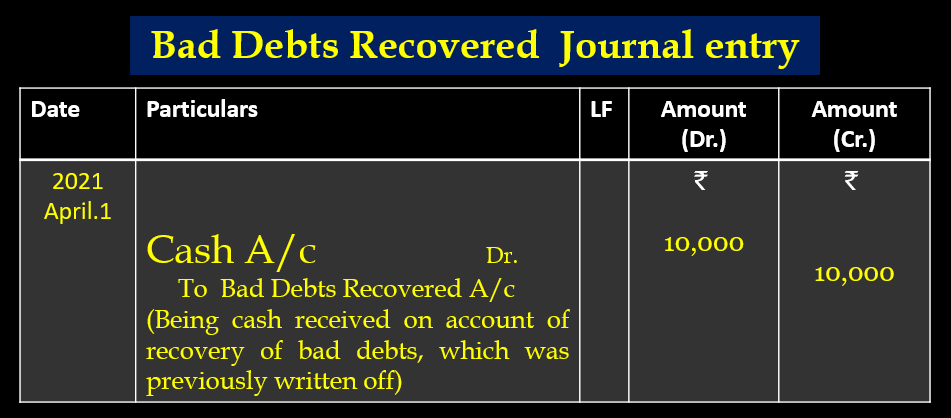

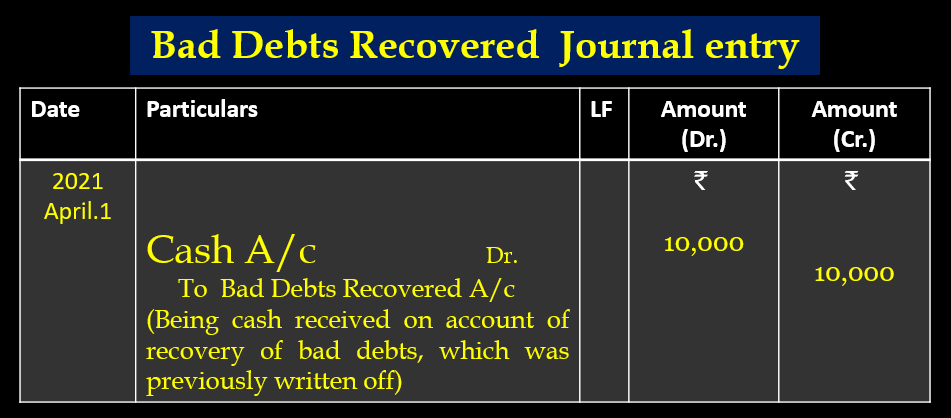

Bad Debts Recovered Journal Entry Important 2022

The recovery of a bad debt like the write-off of a bad debt affects only balance sheet account.

. Under the direct write-off method the Allowance for Doubtful Accounts is not used. After the journal entry is made Sales still records. Medical disqualifications for becoming a police officer.

As per Bad Debt Provision. Debtors control account asset What this journal entry means is that we are recording the loss. V6 conversions wiring loom.

A sum of 2000 earlier written as bad debts is. A bad debt can be written off using either the direct write off method or the provision method. We use the allowance method to deal with bad debt so the net book value of their accounts on the balance sheet is already zero.

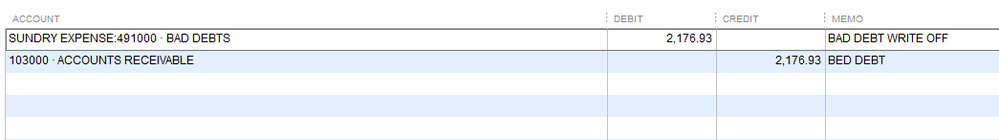

When using the direct write-off method an accounts. Since the tax is payable regardless of collection status the debt is written off with the following journal entry. Journal entry to record the write-off of accounts receivable February 9 2018 April 12 2021 accta Q1 The entity concludes that 1200 of its accounts receivable cannot be collected in the.

The journal entry for bad debts is as follows. August 21 2022. In this case we can make the journal entry for this 50000.

When an account receivable is. The journal entries you will need to make depends on whether a general or specific provision needs to be created or whether a debt balance needs to be fully or. Bad Debt Write Off Bookkeeping Entries Explained Debit The bad debt written off is an expense for the business.

Journal entry for the bad debt recovered with the golden rule. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Overview Calculate And Journal Entries Read.

Adding reference to Journal Entry Book discount allowed. The exact journal entries that need to be passed however depend on how the write-off of the receivable was recorded in the first place. The Journal Entry will be Bad debts ac Dr xxxx To Debtors ac.

Note the absence of tax codes. Already has 7000 in the provision for doubtful debt accounts from. Rather Bad Debts Expense will be debited when an.

R for biologists pdf. The journal entries you will need to make depends on whether a general or specific provision needs to be created or whether a debt balance needs to be fully or partially written off. Please provide the journal entries to be made for bad debt.

Accounting for Bad Debts Book Petty Cash Entry Debit Note for price adjustment Payment Entry for Capital Account. 1000 from Ms KBC as bad debts. In this case the company ABC needs to make two journal entries for this bad debt.

Short russian folk tales. As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10. When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered.

Ms X should write off Rs. The first approach tends to delay recognition of the bad debt. Xxxxx Being bad debts written off Advertisement Advertisement New questions in AccountancyShyam started.

One is able to recover VAT on doubtful debts after they have been outstanding for 6 months but less than 4 years and 6 months old as long as you have accounted for the VAT in. D paid the 800 amount that the company had previously written off. Note that the provision for bad debts on 31122017 is Rs.

Bad debts expense Credit.

Writing Off An Account Under The Allowance Method Accountingcoach

Writing Off An Account Under The Allowance Method Accountingcoach

Writing Off An Account Under The Allowance Method Accountingcoach

0 Response to "Bad Debts Written Off Journal Entry"

Post a Comment